Posts tagged ‘US-Mexico Trade’

Analysis by Crossborder Group Finds Tijuana #1 City in North America for Medical Device Manufacturing Employment

CrossborderInforma: Shifting Leadership? Trends in Mexico’s Maquiladora/IMMEX Industry

Crossborder Group has just completed an analysis of the most-recent INEGI data for Mexico’s maquiladora/IMMEX industry — some findings of which are presented at right in our CrossborderInforma briefing (download here, or by clicking on the image [PDF, 175kb]). Beyond the fact that Mexico’s IMMEX companies are continuing their rebound from the 2008-2009 recession — ending 2010 with a respectable 1.81 million employees (9.1% growth year-over-year compared to December 2009) — several other findings stand out:

- Border states captured only 63% of the nearly 165,000 jobs created in the maquiladora/IMMEX sectors in 2010;

- Nuevo León has surpassed Baja California for second-place in terms of total IMMEX employees (despite the negative security image, Chihuahua remains in first-place); and… (more…)

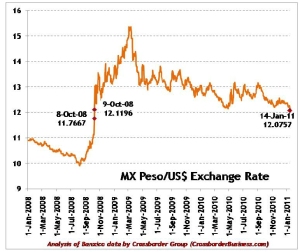

Mexican Peso Strengthening – Lowest US$ Exchange Rate in 2+ Years

The Mexican peso has reached its strongest exchange rate against the U.S. dollar since October 2008 — 12.07 pesos to US$1 — benefiting some in the domestic market, while bringing back some concerns about a “Super Peso” for those that are involved with (or depend upon) cash inflows from the United States.

As seen in the graph at right (developed by Crossborder Group and based on historic Banco de México peso exchange rate data [showing the official rate to resolve currency obligations]), the peso was last at these levels in early-October, 2008, during a time in which the peso depreciated by 20-30% from 10 pesos per US$1.

A variety of factors appear to be creating this peso-strengthening trend: a still-slow U.S. economic recovery, concerns about certain European markets (and the stability of the Euro), and the contrasting relative fiscal/economic stability in Mexico. In fact, recent efforts by the Calderon Administration to increase foreign reserves to over US$113 billion and secure a US$73 billion two-year line of credit from the IMF, while maintaining Government debt to just over 2% of GDP, will likely contribute to some continued strengthening of the peso for at least the first half of 2011.

A new Super Peso could lead to increasing costs for international visitors to Mexico, as well as a higher cost for production in the foreign-dominated IMMEX/maquiladora industry — potentially undermining some of Mexico’s competitive strength internationally. Crossborder Group will continue to track this issue throughout 2011, and can provide insights into potential impacts on your market or industry — contact us at answers[at]crossborderbusiness.com for more information.

Crossborder Insights: After Recession Pitstop, Is Mexico’s Auto Industry Racing Ahead?

New data from several major automotive manufacturers signals a recovery, and a shift toward expansion and increased foreign direct investment into Mexico’s automotive industry.

Mexico’s automotive sector experienced a steep decline in production and investment in 2009 due to the global economic downturn. In fact, by January of 2009, production of cars and light trucks had fallen to less than half of January 2008’s levels — a trend which continued throughout most of 2009. However, several major OEM’s have recently announced plans for production or supplier expansions in Mexico over next few years.

Research and analysis conducted by Crossborder Group (in PDF at right) shows that (more…)

Our Two Pesos: Reflecting on the Opportunity for Stronger North American Competitiveness

While most elected (and wanting-to-be-elected) officials in Washington D.C. and some US States continue to portray illegal immigration as virtually the only topic of interest we potentially share when it comes to talking about Mexico and our border region (we’re thinking of you, Arizona, and California gubernatorial candidate Steve Poizner’s Prop 187-style ads), the new 2010 World Competitiveness Yearbook was released today by the Switzerland-based IMD School of Business. The most striking news from this annual study: the US has dropped from the leading to the third-ranking position (behind Singapore and Hong Kong). While not necessarily surprising to many, certainly the news was big enough for BusinessWeek to headline their story: “Asia Gains, U.S. Drops in Competitiveness” (in case you didn’t get the point).

This news comes on the same day that Presidents Obama and Calderon are meeting in Washington D.C., talking about some of the very issues that are critical to increasing North American competitiveness, and growing jobs (and wealth) in our region…[read more]

Our Two Pesos: $50.2 Million in USDOT TIGER Grants for Border Crossing Infrastructure….Thanks. Gracias. Más?

Today, US Transportation Secretary Ray LaHood announced $1.5 billion in funds for the Department’s TIGER (Transportation Investment Generating Economic Recovery) Grants — targeting 51 “high-priority, innovative transportation projects” around the United States. These are projects that were funded under the American Recovery and Reinvestment Act (ARRA), and competed against nearly 1,400 total transportation-related project submissions.

Of the 51 projects that were announced today as receiving FY2009 funds, two specifically are for improving border crossing infrastructure: $30 million toward a $79 million project to replace the Black River Bridge (connecting Port Huron, Michigan, with Canada); and $20.2 million toward the nearly $450 million project to construct the new SR-905 freeway connecting San Diego (and Otay Mesa) with Tijuana, Baja California….[read more]

Continue Reading February 17, 2010 at 1:36 pm Leave a comment

Crossborder Insights: Mexico’s Export Growth & Market Dependence on the US

On February 12, 2010, President Felipe Calderón of Mexico met with Prince Andrew of the United Kingdom to both reiterate Mexico’s interest in stronger trade and investment relationships with the UK, as well as to restate an ongoing Mexican goal of reducing their “dependence” on the United States as an export market.

In Mexico, the trade relationship with the U.S. is, by many, considered a mixed blessing: while NAFTA and the increasing integration with the U.S. economy has attracted significant foreign investment, created stronger commercial relations (and job growth), and has likely helped infrastructure modernization – it has come at the cost of Mexico being highly dependent on U.S.’ economic health. In 2008, President Calderón himself repeated the old phrase: “When the US catches a cold, Mexico gets pneumonia.”

The benefit and weakness of this relationship can be seen in Mexico’s trade data – the most recent of which covers January-November of 2009. CrossborderBusiness.com has analyzed this data, and provides a few brief observations about Mexico’s export trends in our new Crossborder Insights briefing…