Archive for January, 2011

Got a Question for Border Crossers? Try Crossborder’s Quarterly At-Border Survey Services

Since we started doing at-border surveys in 2003, one of our goals has been to make finding information out about this binational marketplace more affordable — and to provide useful data to businesses and policy makers without waiting for infrequent (and really expensive) studies… Our recent CrossborderInforma briefing about crossborder holiday shoppers and their economic impact on San Diego (read it here), in fact, reflects those goals.

Well, today we’re happy to announce a new Quarterly, at-border survey service –pre-scheduled times each quarter to ask 4 to 8 of your questions at very affordable prices (check out our Quarterly Omnibus Survey flyer in PDF, here or below). This at-border survey service uses trained, bilingual Crossborder staff with PDAs, and can cover the entire California-Mexico border (San Ysidro, Otay Mesa, Tecate, Calexico, Calexico East and Andrade — with other POEs optional).

Got questions you want to ask border crossers? Download our CrossborderSurveys Quarterly Omnibus overview — and contact us today about our Spring and Summer 2011 survey sessions (multi-season discounts available!). We can help you answer questions about the hundreds of thousands of border crossers people that make up the US-Mexico border economy!

Questions? Email us at Answers[at]CrossborderBusiness[dot]com.

Border Surveys: Crossborder Holiday Shoppers Leave the Green in San Diego Stores

Crossborder Group has released initial findings from their December 2010 (Winter Quarter) at-border surveys, conducted among nearly 1,000, randomly-selected northbound car, SENTRI, and pedestrian travelers at the San Ysidro and Otay Mesa Ports of Entry. These results (download PDF at right) highlight nearly 800 responses from Mexico-residing visitors into San Diego and their Christmas Holiday purchases in San Diego County.

“Since 2003 we’ve been surveying border crossers, and have repeatedly asked Mexican shoppers to estimate their household expenditures on Christmas gifts purchased in San Diego,” explains Kenn Morris, President of California-based Crossborder Group and it’s Mexico subsidiary, Crossborder NS, S de RL de CV. “This last Holiday season, Baja California visitors estimated that they’d spent $536 dollars per household on Christmas gifts purchased in San Diego — that’s an enormous and positive economic impact that the public should know about.” (more…)

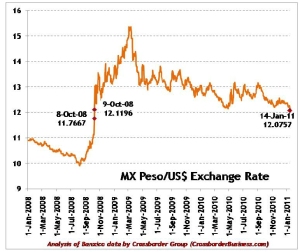

Mexican Peso Strengthening – Lowest US$ Exchange Rate in 2+ Years

The Mexican peso has reached its strongest exchange rate against the U.S. dollar since October 2008 — 12.07 pesos to US$1 — benefiting some in the domestic market, while bringing back some concerns about a “Super Peso” for those that are involved with (or depend upon) cash inflows from the United States.

As seen in the graph at right (developed by Crossborder Group and based on historic Banco de México peso exchange rate data [showing the official rate to resolve currency obligations]), the peso was last at these levels in early-October, 2008, during a time in which the peso depreciated by 20-30% from 10 pesos per US$1.

A variety of factors appear to be creating this peso-strengthening trend: a still-slow U.S. economic recovery, concerns about certain European markets (and the stability of the Euro), and the contrasting relative fiscal/economic stability in Mexico. In fact, recent efforts by the Calderon Administration to increase foreign reserves to over US$113 billion and secure a US$73 billion two-year line of credit from the IMF, while maintaining Government debt to just over 2% of GDP, will likely contribute to some continued strengthening of the peso for at least the first half of 2011.

A new Super Peso could lead to increasing costs for international visitors to Mexico, as well as a higher cost for production in the foreign-dominated IMMEX/maquiladora industry — potentially undermining some of Mexico’s competitive strength internationally. Crossborder Group will continue to track this issue throughout 2011, and can provide insights into potential impacts on your market or industry — contact us at answers[at]crossborderbusiness.com for more information.